MACD 3MA

The MACD 3MA indicator is a modification of the standard MACD.

MACD ( Moving Average Convergence/Divergence) is a technical indicator developed by Gerald Appel for the evaluation and prediction of price fluctuations in the stock and currency markets.

For the MACD calculation, an exponential moving average with a larger period is subtracted from a moving average price (usually an exponential MA with a smaller period is used. In most cases, the result is smoothed using EMA to eliminate random fluctuations.

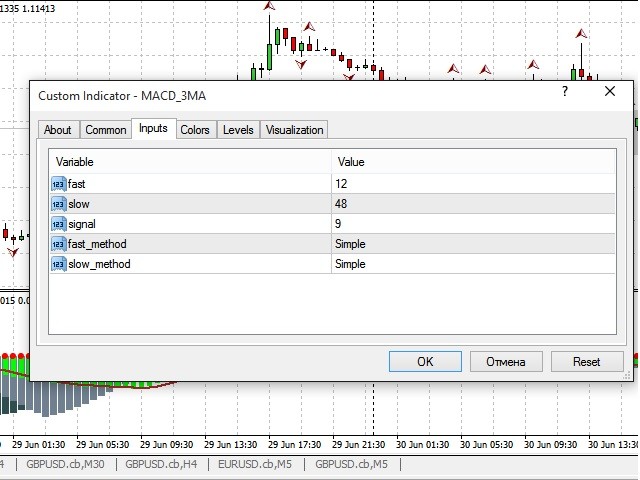

Unlike the standard MACD MACD 3MA is built on three MAs and two standard MACDs. The man purpose of MACD 3MA is the following:

- Determining the beginning and the end of an impulse movement.

- Determining the current direction of the price movement

- Defining entry points

Let's start with the impulse. The first screenshot features three histograms: a) dark gray (impulse) b) gray (corrective) c) light green (signal). Also it has a signal line (brown). Impulse histogram is the price movement acceleration. If the histogram is above 0, then an upward movement is developing. If it is below 0, the movement is downward.

状态:离线 发送信件 在线交谈

姓名:顺水的鱼(先生)

职位:投机客

电话:18391752892

手机:18391752892

地区:默认地区

地址:西安市高新区软件园

邮件:3313198376@qq.com

QQ:3313198376

微信:18391752892

阿里旺旺:顺水的鱼waterfish

Skype:3313198376@qq.com