PZ Correlation

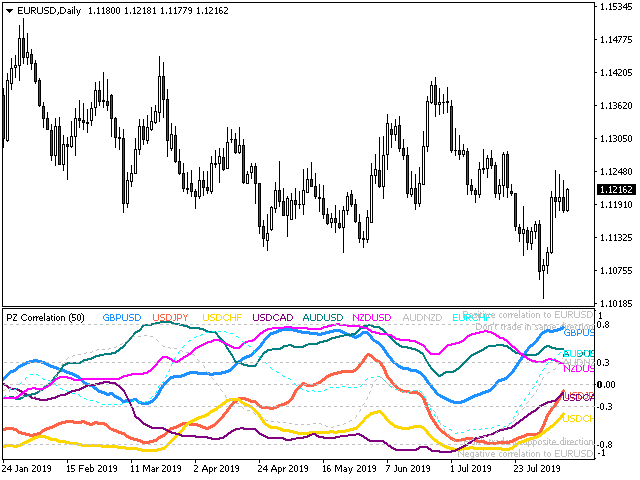

In the world of finance, correlation is a statistical measure of how two securities move in relation to each other. Correlations are used in advanced portfolio management. This indicator measures how different securities move in relation to a reference one, thus making portfolio management easier. [ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ]

- Avoid concurrent trades in highly correlated instruments

- Find trading opportunities among highly correlated instruments

- Correlation is positive when two securities rise in price together

- Correlation is negative when one security increases and the other decreases

The correlation between two securities is measured by a correlation coefficient.

- A coefficient of zero is neutral correlation

- A coefficient of 0.3 is low positive correlation

- A coefficient over 0.8 is high positive correlation

- A coefficient of -0.3 is low negative correlation

- A coefficient over -0.8 is high negative correlation

The correlation is calculated against the native symbol of the chart, and the symbols to evaluate are entered as parameters.

联系方式

公司:顺水的鱼外汇EA

状态:离线 发送信件 在线交谈

姓名:顺水的鱼(先生)

职位:投机客

电话:18391752892

手机:18391752892

地区:默认地区

地址:西安市高新区软件园

邮件:3313198376@qq.com

QQ:3313198376

微信:18391752892

阿里旺旺:顺水的鱼waterfish

Skype:3313198376@qq.com

状态:离线 发送信件 在线交谈

姓名:顺水的鱼(先生)

职位:投机客

电话:18391752892

手机:18391752892

地区:默认地区

地址:西安市高新区软件园

邮件:3313198376@qq.com

QQ:3313198376

微信:18391752892

阿里旺旺:顺水的鱼waterfish

Skype:3313198376@qq.com