Swiss ORIndicator

Opening Range Indicator

Idea

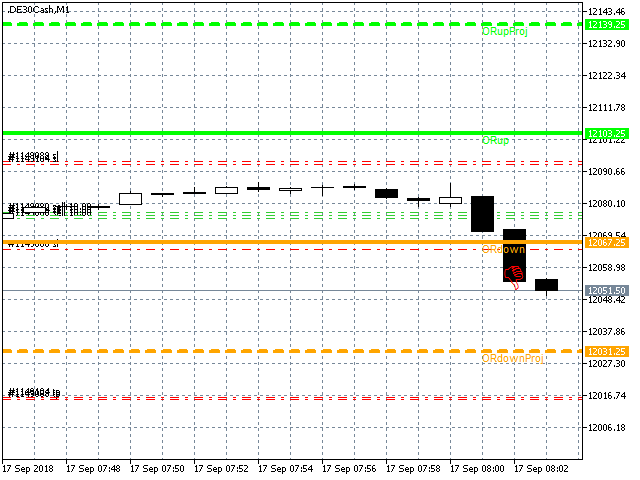

Toby Crabel introduced this way of trading in the ealy ninties in his book "Day Trading with Short Term Price Patterns and Opening Range Breakout". In simple terms this means to trade the brekouts from the limits of the first trading hour with the stop loss at the opposite side. I.e. if the first hourly candle meausres 40 points (Crabel calls this the "stretch") you set the stop loss at breakout level minus 40 points and the take profit at the breakout level plus 40 points. The same with a brekout to the downside.

In todays nervous markets the ideas of Crabel do not work as exactly as in former times. But I think that the first hour of index trading is still very significant for the whole day, especially if there are range markets. For the german Dax the hour before the opening (08:00 to 09:00) seems to be very significant. In many instances the opening range is revisited or the breakout goes exactly to the projection of the range.

This indicator is less for trading exactly the Opening Range Breakout strategy but for an orientation for the whole day. If you trade ORB anyways I recomend to not set the stop at the other side of the stretch, because it might be a far too big stop loss. Position it tighter (for Dax about 15 to 20 points).

Features

- Draws lines at the levels of the last hour candle

- Draws projections on the upper and lower side

- Warns you by a specific signal if price crosses levels

- Selection of local or server time

- Enter range levels by hand if you missed the first hour of trading

- The values of the ranges get saved in global variables (f3)

- You can change timeframe, values are reread from global variables

Installation

状态:离线 发送信件 在线交谈

姓名:顺水的鱼(先生)

职位:投机客

电话:18391752892

手机:18391752892

地区:默认地区

地址:西安市高新区软件园

邮件:3313198376@qq.com

QQ:3313198376

微信:18391752892

阿里旺旺:顺水的鱼waterfish

Skype:3313198376@qq.com