Value Chart for MT4

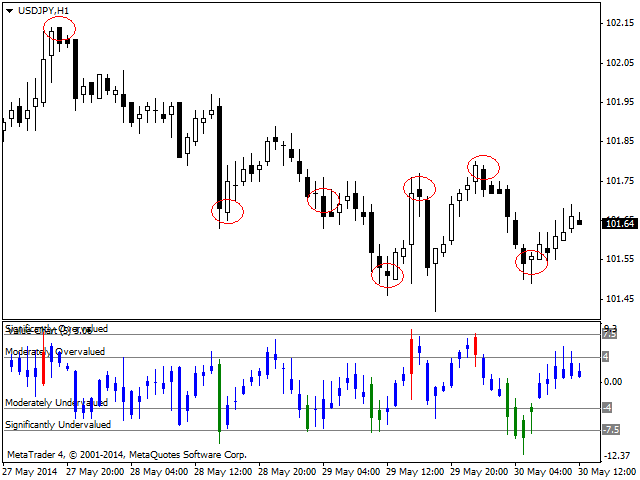

Value Charts (Helweg and Stendahl, 2002) is an innovative charting technique that displays price in terms of value instead of cost even when price volatility changes over time. It shows you when a particular market is at an extreme level and is likely to reverse.

How to interpret

The Value Chart indicator defines market valuation by plotting price in one of five primary valuation zones, which include:

- Significantly Overvalued

- Moderately Overvalued

- Fair Value

- Moderately Undervalued

- Significantly Undervalued

When the Value Chart indicator reaches a significant level, the bar is coloured appropriately to indicate a long or a short opportunity. It turns red when an instrument is significantly overvalued (short opportunity) and green when significantly undervalued (long opportunity).

Trading strategy example

Bull markets tend to have quick, sharp pullbacks and then slow grinding moves higher. In this strategy we use the Value Chart to identify temporary pullbacks to join the trend.

- Use a moving average or the Hysteresis indicator to determine the overall trend.

- once an uptrend is indicated by the moving average, look to buy when the market trades below the -8 Value Chart price level.

状态:离线 发送信件 在线交谈

姓名:顺水的鱼(先生)

职位:投机客

电话:18391752892

手机:18391752892

地区:默认地区

地址:西安市高新区软件园

邮件:3313198376@qq.com

QQ:3313198376

微信:18391752892

阿里旺旺:顺水的鱼waterfish

Skype:3313198376@qq.com