ARUNind

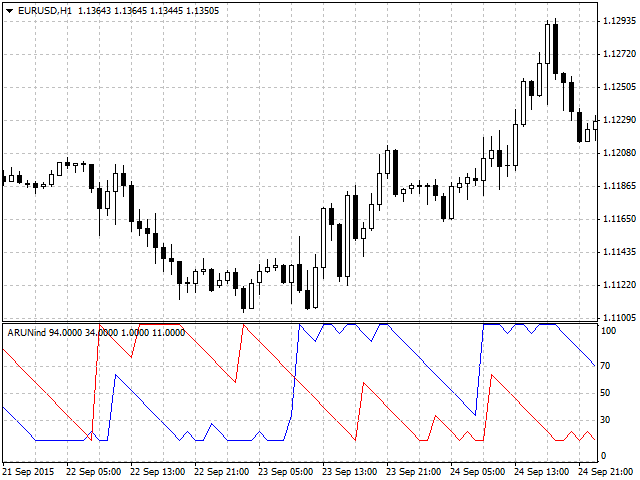

Arun indicator can be used to define trend direction and strength. Besides, it can detect a trend turning into flat which is quite an important thing since technical analysis indicators are usually most efficient during trends.

Calculation

The indicator is calculated based on the parameter of a time periods' value. The amount of periods since the occurrence of the maximum and minimum values within a single time trading period or range is calculated when dislaying the indicator.

- Arun (up) indicator = (amount of trading periods minus amount of trading periods of the maximum value)/amount of trading periods*100%

- Arun (down) indicator = (amount of trading periods minus amount of trading periods of the minimum value)/amount of trading periods*100%

Values

- Arun (up) indicator — amount of periods passed since the daily market High.

- Arun (down) indicator — amount of periods passed since the daily market Low.

Arun (up) (down) indicators vary from 0 to +100.

Usage

When Arun (down) indicator (red line) is above 70, while Aroon (up) indicator (blue line) is below 30, a trend is bearish. 70 and 30 are consolidation levels.

If Arun (up) indicator is above 70, while Arun (Down) is below 30, a trend is strongly bullish.

If Arun (up) and Arun (down) indicators are in the middle of the chart (50 points), the market is consolidating.

Values exceeding 70 mean a strong trend in the same direction.

Varying the length of a trading period, the indicator can display short- and long-term trends. The default value is 25 Arun periods, though you can use shorter intervals as well.

状态:离线 发送信件 在线交谈

姓名:顺水的鱼(先生)

职位:投机客

电话:18391752892

手机:18391752892

地区:默认地区

地址:西安市高新区软件园

邮件:3313198376@qq.com

QQ:3313198376

微信:18391752892

阿里旺旺:顺水的鱼waterfish

Skype:3313198376@qq.com