Ichimoku Fanatic

This is a semi-automated system based on Ichimoku Kinko Hyo.

It tracks your deals opened according to the Ichimoku Kinko Hyo strategy.

The system consists of three open position tracking blocks:

- tracking positions by placing Stop Loss according to Ichimoku cloud;

- tracking positions by placing Take Profit according to Ichimoku cloud;

- tracking positions by closing them according to specified Ichimoku signals;

The EA tracks any amount of simultaneously opened orders. The trading robot tracks only the manual trades (magic = 0) on a symbol it is attached to.

Note: In test mode, the EA opens Buy and Sell orders at the first tick allowing you to visually examine the built-in logic by changing the EA parameters. For more visibility, attach Ichimoku Kinko Hyo indicator with the parameters set for Ichimoku Fanatic EA to a chart. The trading robot does not open orders in real time.

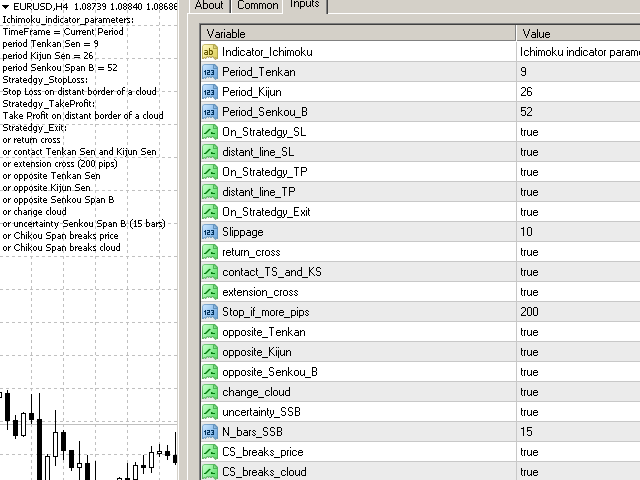

Parameters

- Indicator_Ichimoku - Ichimoku Kinko Hyo parameters;

- Period_Tenkan - Tenkan Sen period;

- Period_Kijun - Kijun Sen period;

- Period_Senkou_B - Senkou Span B period;

- On_Stratedgy_SL - enable/disable Ichimoku-based Stop Loss strategy;

- distant_line_SL - if true, set Stop Loss at the cloud border farthest from the price, if false - at the closest one;

- On_Stratedgy_TP - enable/disable Ichimoku-based Take Profit strategy;

- distant_line_TP - if true, set Take Profit at the cloud border farthest from the price, if false - at the closest one;

- On_Stratedgy_Exit - enable/disable Ichimoku-based market exit strategy;

- Slippage - slippage in points (for 5 digits; recalculation is performed automatically for 4-digit brokers);

- return_cross - return cross (for a Buy position, Tenkan is less than Kijun, while for a Sell one, Tenkan exceeds Kijun);

- contact_TS_and_KS - Tenkan and Kijun lines' crossing (Tenkan is equal to Kijun), return_cross is included as well;

- extension_cross - weakening of the cross: the distance between Tenkan and Kijun exceeds the value specified in Stop_if_more_pips (for a Buy position, Tenkan minus Kijun exceeds Stop_if_more_pips, for a Sell position - Kijun minus Tenkan exceeds Stop_if_more_pips), return_cross is included as well;

- Stop_if_more_pips - amount of points for extension_cross (for 5 digits, recalculation is performed automatically for 4-digit brokers);

- opposite_Tenkan - reverse Tenkan line movement relative to an open deal (for a Buy position, Tenkan is directed downwards, while for a Sell one - upwards);

- opposite_Kijun - reverse Kijun line movement relative to an open deal (for a Buy position, Kijun is directed downwards, while for a Sell one - upwards);

- opposite_Senkou_B - reverse Senkou B line movement relative to an open deal (for a Buy position, Senkou B is directed downwards, while for a Sell one - upwards);

- change_cloud - change Ichimoku cloud (Senkou B and Senkou A line switch places);

- uncertainty_SSB - Senkou B line uncertainty (Senkou B does not change the value of N_bars_SSB);

- N_bars_SSB - amount of bars for uncertainty_SSB;

- CS_breaks_price - Chikou Span breaks out the price (for a Buy position, Chikou Span line is below the price on the same bar, while for a Sell one, it is above the price);

- CS_breaks_cloud - Chikou Span breaks Ichimoku cloud (for a Buy position, Chikou Span line is below Ichimoku cloud on the same bar, while for a Sell one, it is above the cloud).

Timeframe for the Ichimoku indicator in the strategies is similar to the one the EA is launched at.

状态:离线 发送信件 在线交谈

姓名:顺水的鱼(先生)

职位:投机客

电话:18391752892

手机:18391752892

地区:默认地区

地址:西安市高新区软件园

邮件:3313198376@qq.com

QQ:3313198376

微信:18391752892

阿里旺旺:顺水的鱼waterfish

Skype:3313198376@qq.com